Recovering $400k+ Annually via Hybrid Machine Learning

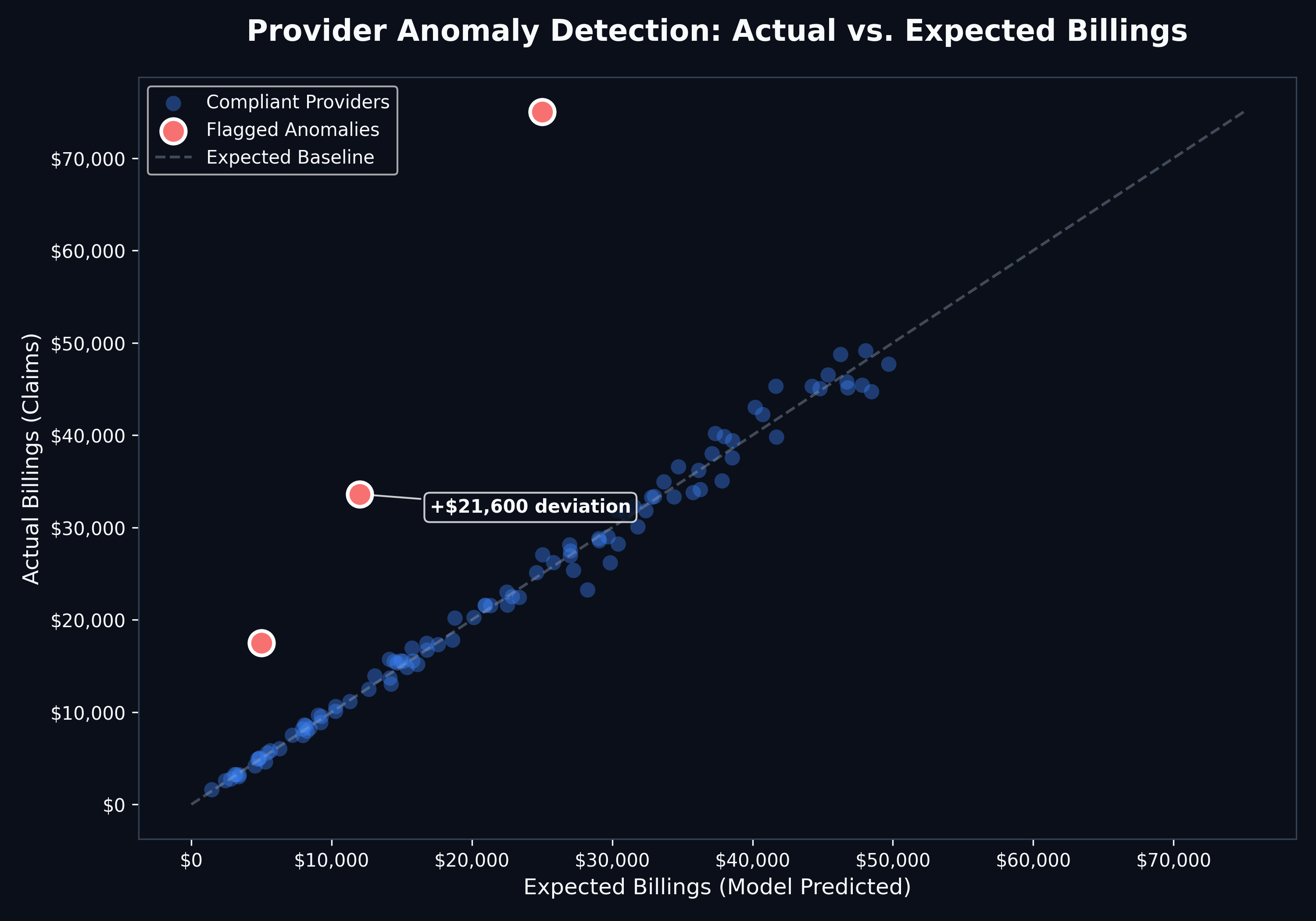

A health insurer's existing rule-based system successfully flagged straightforward fraud patterns, but could only identify a small fraction of actual fraudulent claims. The real risk lay in sophisticated actors who had studied and deliberately circumvented those rules — schemes that, by design, looked fully compliant on the surface. Without AI-driven outlier detection, these cases went completely undetected.

We designed and deployed a comprehensive fraud detection framework. Moving beyond simple static rules, the solution utilized a hybrid approach:

Supervised Learning: Trained on historical confirmed fraud cases to catch known patterns.

Unsupervised Learning: Anomaly detection to flag novel, previously unseen fraud schemes.

Automated Triage: A Python-based pipeline that prioritized cases with the highest probability of recovery.

Workflow Integration: Scoring outputs were embedded directly into the existing audit management platform, so analysts could action flags without changing their day-to-day tooling — maximising adoption from day one.

$400k+

Recoveries

+60%

Findings

50%

Automation

>80%

Precision